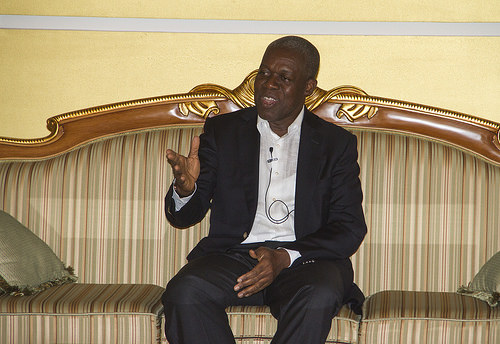

Vice President Kwesi Amissah-Arthur

The 37th Annual General Meeting of Africa Reinsurance Corporation to discuss the Corporation’s performance and future plans is underway in Accra.

The meeting brings together African insurance companies and seeks to promote the growth of national and regional underwriting of risks to foster the development of retention capacities of the insurance and reinsurance industry to promote the continent’s economic development.

Africa Reinsurance was established in 1976 under an Africa Union International Agreement with the aim of reducing the overflow of foreign capital from the continent by retaining a substantial proportion of reinsurance premiums.

In his opening remarks, Vice President Kwesi Bekoe Amissah-Arthur, whose speech was read on his behalf, said the contribution of the insurance and reinsurance industry provides risk management and financial security to businesses.

It is also a key source for the mobilisation of funds for long-term investment.

Vice President Amissah-Arthur said Africa has no option but to work towards a continent that is integrated with robust infrastructure that promotes trade, more industrialised and moving away from exports of primary products.

He said many of the recognised constraints to the growth of African economies are on the supply-side and to address that Africa needs to improve the quality of governance, develop institutional capacity and invest in infrastructural development.

Vice President Amissah-Arthur said as part of the African transformation agenda, access to finance is key to unlocking growth, expanding exports and promoting sustainable development.

“ Africa does not only need funds, but also a more effective and inclusive means of channeling funds and other financial services to where they can be most effective,” he added.

He said according to SwissRe in 2011, Africa’s reinsurance market represented 0.8 per cent of the world share in direct premiums compared to 2.8 per cent for Latin America and 10 per cent for emerging markets.

He said Africa needs to develop both general and life insurance products that could promote transformational agenda, hence the need to consider health insurance, micro-insurance, agricultural insurance and other products to reduce poverty.

Mrs Lydia Lariba Bawa, Commissioner of Ghana Insurance Commission said the insurance penetration in the country and most sub Saharan African countries is below two per cent and is because most insurance products and services tend to predominantly focus on the formal sector businesses.

She said the National Insurance Commission had designed and implemented a microfinance regime in collaboration with German International Cooperation to increase the insurance penetration rate.

Mrs Bawa said the Commission had implemented a new solvency framework, which required insurance companies to meet new minimum capital requirements, calculate technical provisions based on sound methodologies and adopt effective risk management and corporate governance systems.

Mr Hassan Boubrik, Chairman of African Reinsurance, said despite setbacks that are inherent in the development of every economy, Ghana is one of the fastest growing economies in Africa.

Source: GNA