Central banks in Africa are turning to gold to protect themselves from economic and geopolitical instability and to diversify their financial portfolios.

In September 2023, the price of gold per ounce was $1,900. A year later, it is selling for $2,500. According to the World Gold Council, an international trade association for the gold industry, demand for the metal is expected to increase in the next 10 months despite the soaring prices.

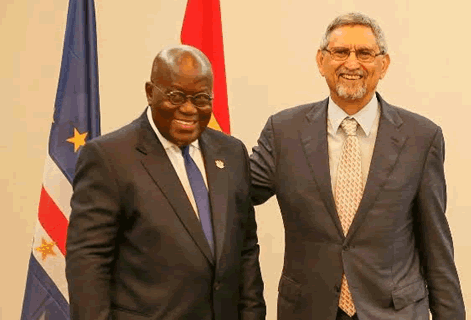

Some experts, such as Carlos Lopes, a professor at the Nelson Mandela School of Public Governance in South Africa, attribute the African central banks’ gold rush to the need to protect their local currencies.

“In the last few years, because of inflation and all these movements for stimulation packages and the rest, the returns are extremely low,” Lopes said. “On the other hand, gold is going up in terms of price because these big banks are also going after gold as a protection. So, it is a very good investment to go to gold.”

It helps that African gold production has grown by 60% since 2010, according to the World Gold Council, higher than a global increase of 26%.

In 2022, Zimbabwe launched a gold-backed currency to curb inflation and volatility in foreign exchange rates.

Ghana and Uganda have been buying gold from artisanal miners to bolster their shrinking foreign currency reserves.

Ghana, Africa’s largest gold producer, plans to buy oil from other countries and pay them in gold to ease pressure on local currency and lower high fuel prices.

Some economists say gold cannot solve the economic problems of some African countries.

According to the World Gold Council, countries should hold onto gold for its long-term value, performance during crises and its role as an effective portfolio diversifier.

Bright Oppong Afum, a senior lecturer at the University of Mines and Technology in Ghana, said some African countries want to use gold to reduce their reliance on the global financial system.

“If sanctions are laid on you, an African country, we know the devastating effects that it will have,” he said. “The African countries are developing, or they are young, and they do not want to receive some harsh sanctions that will negatively or strongly impact the economics. And because of that, they are strategically reducing their dependencies on these external countries.”

Afum said that although some Africans know and understand the value of gold, many trade away the metal to satisfy their daily needs.

“So, they just find a mere buyer who will … exploit them,” he said.

The African Continental Free Trade Area introduced the Pan-African Payment and Settlement System, enabling countries to trade in local currencies. Experts say some continental payment systems, if implemented, can ease the economic pressures some countries are grappling with.

That, in turn, might make them less dependent on gold.

Source: voanews.com