Heads of State (Presidents of Ghana, Rwanda and Uganda, HE John Dramani Mahama, Paul Kagame and Yoweri Museveni and the Prime Minister of TZ) at the Presidential Panel at TGAIS

Over 500 of the city’s pension funds, sovereign wealth funds, private equity firms, asset managers, bankers, corporates, professional services firms and project developers, collectively representing over USD265 billion in capital, convened today at the Savoy Hotel for The Global African Investment Summit (TGAIS) to review the continent’s most bankable projects in strategic sectors spurring the continent’s growth and competitiveness: power and transport infrastructure, agribusiness, natural resources and tourism.

The Summit, opened by former President of Nigeria Olusegun Obasanjo, Lord Mayor of London Fiona Woolf and First Secretary of State William Hague, is seeking to direct funds from some of the world’s largest institutional investors into quality projects across the continent.

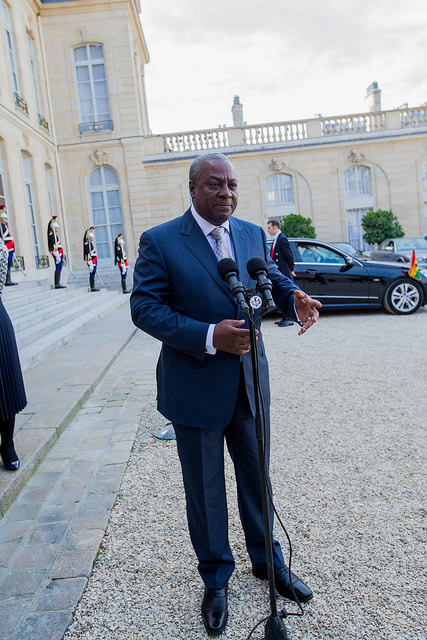

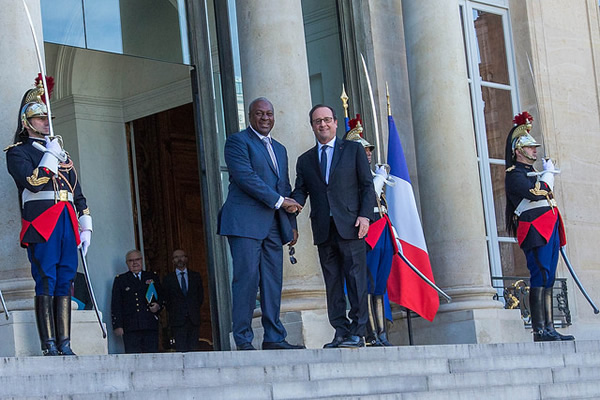

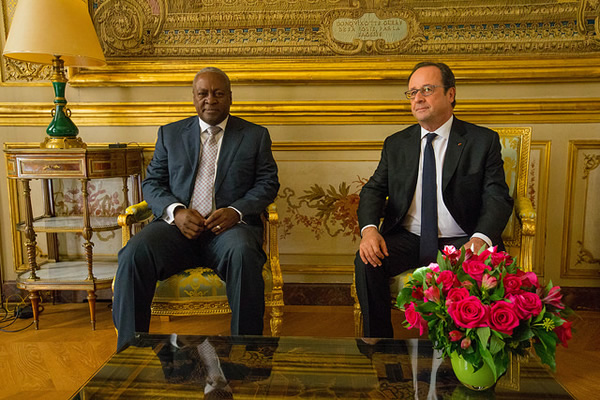

A hundred and thirty-six bankable projects worth a combined total of $US246 billion will be presented during the Summit, which was addressed by the Presidents of Ghana, Rwanda and Uganda, HE John DramaniMahama, Paul Kagame and Yoweri Museveni respectively, and the Prime Minister of Tanzania MizengoPinda during the presidential keynote panel.

Speaking about her visit to South Africa, Kenya, Tanzania and Uganda last month Lord Mayor Fiona Woolf remarked: “Africa is at the front and centre of our agenda, which is growth and jobs. The continent is a key area of focus for the City of London and a key geography for the financial sector; we want to deepen our relationship with all participant nations. We can work with business to make a contribution in many fields, to support growth and development and create capacity, added value and jobs.”

Highlighting UK-Africa relations,RtHon William Hague said “the British government is investing in relationships across Africa as never before. We are expanding our diplomacy and backing British businesses investing and trading in Africa with unprecedented energy and determination, because we know that this is Africa’s moment and we want to be the partner of choice for African nations in the coming decades. We see an Africa of opportunity, with six of the ten fastest growing economies in the world, a young and growing population, and vast natural resources, and limitless potential if aspirations can be met with education, job creation and good governance. We are determined to be a partner for sustainable growth that benefits Africa and British businesses.”

During the presidential panel, President of Ghana HE John DramaniMahama noted “governments in Africa have come to the realization that we cannot make enough public sector investment to finance infrastructure projects – we need the private sector. We need to be innovative in our financing, such as creating tax incentives for companies that are investing in infrastructure and energy, through public private partnerships and joint ventures.”

Following the opening remarks, thematic panels and roundtables were held covering Africa’s emerging middle class, investor rights, the growing agribusiness sector, natural resources and the family office.

Speaking at a panel focused on serving the emerging middle class, JinGuangze, Vice President of the China-Africa Development Fund said “diversifying Africa’s economies is very important for Africa’s development in the long run. We have to date committed approximately US$3 billion – we are confident that our investment activities have bridged Africa’s investment gap to a certain extent. We nevertheless need to implement continuous investment in infrastructure, agriculture and other key sectors to prioritise Africa’s development.”

Tomorrow will see the second and final day of TGAIS, with opening remarks from former President of Nigeria Olusegun Obasanjo and panels and roundtables on private equity, capital markets, transport and ICT infrastructure and financing’s Africa’s power sector. The summit ends with a drinks reception hosted by the Foreign and Commonwealth Office.

TGAIS is sponsored by a range of African and multinational companies, including Invest Africa, PwC, Sepco, Visa, Baker and McKenzie, Ecobank, Globeleq, Heritage Bank, Prudential, Seplat, Standard Chartered, Denham Capital, DLA Piper, Greenheart Energy, Greenwich Trust, Liquid Telecom, Salamanca Group, Tullow Oil, Mozambique LNG, Winston and Strawn, Access Bank UK, Bombardier, Clarke Energy, Ghana International Bank, Nedbank Capital and PW Power Systems.