Christine Lagarde – Managing Director of IMF

Ghana and the International Monetary Fund probably won’t come to an agreement on aid until April and the country will struggle to meet revenue targets next year, according to Fitch Ratings Ltd.

The world’s second-biggest cocoa producer turned to the Washington-based lender as it struggles to narrow its fiscal deficit. A target to reduce the gap to 6.5 percent of gross domestic product in 2015 from 9.5 percent is “exceptionally ambitious,” said Carmen Altenkirch, director of the sovereign group at Fitch.

“I’ve penciled in a figure of 8 percent,” she said at a conference today in London. “The real challenge for them will be raising revenue at a time when the economy isn’t performing well.”

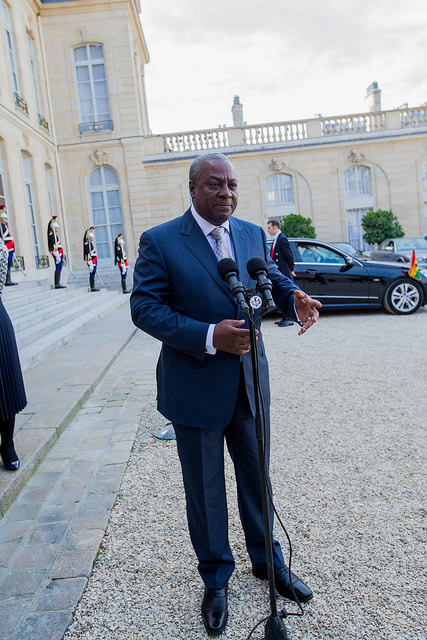

Lower earnings from exports and higher spending weighed on the budget in West Africa’s second-biggest economy and added pressure on the cedi, the continent’s worst-performing currency this year. Rising debt, power shortages and soaring inflation prompted President John Dramani Mahama to open the door to IMF aid in August.

The government would probably finish talks with the lender by February, James Klutse Avedzi, chairman of the finance committee in Parliament, said on Nov. 19.

“The first time, all things going well, that we’re likely to see an IMF program is April next year,” Altenkirch said, without giving details. “If they don’t have an IMF program, they won’t be able to issue another Eurobond. Then, you’re going to get a very large drain on reserves.”

Budget Financing

Ghana sold $1 billion of January 2026 bonds, priced to yield 8.25 percent, in September, according to data compiled by Bloomberg. That was its third offering in dollars and was issued a few weeks after signaling it wanted IMF aid. The country’s international bonds returned 8.7 percent this year, less than the 10.4 percent average gain for the Bloomberg USD Emerging Market Sovereign Bond Index.

After losing access to domestic capital markets, Ghana was forced to borrow money from the central bank, according to Altenkirch.

“Banks have become net sellers of government paper, while non-banks have purchased only half of what the government was intending,” she said. “The central bank has financed roughly 90 percent of Ghana’s budget this year.”

Two calls made to Finance Minister Seth Terkper and his deputy, Cassiel Ato Forson, weren’t answered. The cedi, which is down 26 percent this year, weakened 0.4 percent to 3.2152 per dollar by 5 p.m. in Accra.

Credit: Bloomberg